About Diamondhead Coal Sales

Diamondhead Coal Sales is an energy company focused on the mining and supply of thermal, metallurigcal and specialty coal products for the demanding needs of the United States and world energy markets.

Areas Of Focus

-

Coal is produced for our customers via contour area mining, high-wall mining, and underground mining methods.

-

Mining applications which are required to produce specialty, metallurgical and thermal products. Advanced systems for production are needed to be on the leading edge.

-

Abundant contiguous reserved which provide consistent long term product offerings to the customer.

-

Utility and commercial customers want reliable, well funded entities to ensure uninterrupted fuel source deliveries while meeting regulatory requirements.

-

Utility and commercial customers receive fuel products via the following transportation modes: railroad, truck, and barging.

-

Producer and customer becoming “teaching” partners providing responsible solutions.

The Solution

The Solution

Sustainable Reserves and Supply

Diamondhead Coal Sales will control over 100MM recoverable tons of high quality thermal, metallurigcal and specialty coals in Eastern Kentucky.

Safe and Reliable Production

The number one focus is always safety for our employees and a premium product for each of our customers.

Energy Supply Solutions

Sustained production for the customer, meeting and exceeding all regulatory requirements to ensure non-interrupted production and delivery.

The Product

Project Solutions

Confirmed reserves and rights to access, production personnel, machinery, transportation of product and transloading facilities to ship a premium product for the customer.

Flexibility

Safe, sensible solutions. Meeting the customers expectations and demands.

Solutions

Solutions the customer requires now and in the future.

Diamondhead Coal Sales Current Product Offerings

-

Diamondhead Coal Sales provides 70MM Short Tons of recoverable thermal, metallurgical, and speciality coal product for the customer with an experienced group of mining experts, production staff and reliable equipment with high availability and utilization.

-

Diamondhead Coal Sales presents the safest and most productive workforce in today’s market, meeting all compliance issues to ensure a smooth, very organized and productive organization.

-

Our equipment and systems are the best in the workplace. Availability and utilization of all equipment and administration processes are equal to or above industry standards.

BUSINESS MODEL AND INFORMATION

The Business Model

Diamondhead Coal Sales is positioned to become a leading provider of energy solutions. The company aims to become a deliverer of high quality thermal, metallurgical, and pulverized coal injection (PCI) coal products to utility, industrial, and commercial clients. This business model outlines the value proposition, key activities, revenue streams, customer segments, and strategic partnerships essential for Diamondhead Coal’s growth and market impact.

The business model is designed from growth through low-cost production, customer-centric solutions, and strategic partnerships, aiming to secure a leadership position in the regional energy sector.

Finance partnerships and stockholder equity positions are central to the business model.

Additional Growth and Opportunity For Success

-

Multi billion-dollar addressable market with various applications, very positive realizations.

-

Solutions with low cost, precise solutions, creating responsible, not impulsive solutions, meeting the demands of the customers' customer.

-

Technology in mining with exponential growth in current and expandable markets.

Market Opportunity - US

535MM ST

Multi million-dollar addressable United States Market per year.

$69T

Total estimated market in North America.

Diamondhead Coal Sales vs. Competition

Our Company

Brings responsible, professional solutions to customers who desire the results offered by very large corporate firms with the same results, but at a fraction of the cost.

Professional owners and operators with over 200+ years of experience in the industry.

Extensive knowledge in safety, reserve analysis, mine planning/engineering including implementation, personnel and production applications, transportation and customer relationship with teaming aspect.

Extensive quality control. Taking care of the “customer’s customer.”

Great relationships with utility, commercial, and industrial customers with respect of SRE management and personnel.

Low overhead and cost saving solutions which are favored by the customer base.

Extremely high accuracy in Administration, Legal, Engineering, Management/Production Staff, Quality Control Specialist.

Safe applications. Number #1 priority!

Competition

Presents high cost, low margin.

Focus on market trends, not customer needs and satisfaction.

High G&A cost, fees, and high production cost due to non-responsive staffing and assets in various departmental structures creating increased percentage of home office allocations.

No “out of the box” thinking to enhance the producer and customers. Chasing the short-term solutions, not focusing on the long term plan.

Not having full focus on safety and the customer which is a receipt for failure.

Taking short cuts, thus realizing short and long term problems.

Chasing market pricing.

Location and Facility

The project is located in eastern Bell County, Kentucky, near Harlan County. It features a 450 ton/hour state-of-the-art coal processing plant and a 110-car rail loadout facility on the CSX network. This coal preparation plant will enhance the quality of the coal product by removing impurities prior to shipments by rail to the end user and meet quality requirements.

Reserves & Mining Operations

Main Coal Seams: Hazard 4, 7, 8, Blue Gem, and Jellico.

No. 4 Seam: Underground mine, 19,000+ clean tons/month, 9-year reserve life.

No. 7 Seam: Underground mine, 16.000+ clean tons/month, 7-year reserve life.

No. 8 Seam: Surface mine (highwall miner), 23,000+ clean tons/month.

Total steady-state annual production: ~699,000+ clean tons.

Expansion & Strategy

Immediate production to start with No. 4 mine, followed by No. 7 and No. 8 seams.

Exploration of adjacent Penn Virginia properties planned expansion.

As reserves are verified, new leases and mined-out properties will be replaced with new ones.

Operational Advantages

Profitability possible at low volumes.

Single lessor simplifies royalty calculations.

Bonding and permits are managed and paid for by a third party.

Growth Strategy - How will we scale in the future?

Phase 1 (2025-2026)

Present a “Letter Of Intent” to existing owner, moving forward on due diligence and transaction.

Strategic plan to grow business from 10,000 ST in April 2026 to 100,000 ST per month production by July 2027.

Continue to utilize current production personnel and equipment, while ensuring controlled cost, maintaining and increasing professional needs of trained personnel and assets.

Securing customer contracts for long term energy needs.

Phase 2 (2026-2027)

Aggressive growth strategy with responsive, not impulsive growth.

Continue aggressive alliance customer bases and seek new customers for continued growth (if needed).

Growth strategy, increasing and stabilizing 100,000 tons of production per month for five year + growth strategy.

Increase presence, upgrading current assets and implementing new technology in mining applicatons.

Phase 3 (2027 and Beyond)

Increase territory presence, trained personnel and asset base while increasing gross revenue by 15%+ per year moving forward.

Increasing presence in thermal, matallurgical and specialty coal markets.

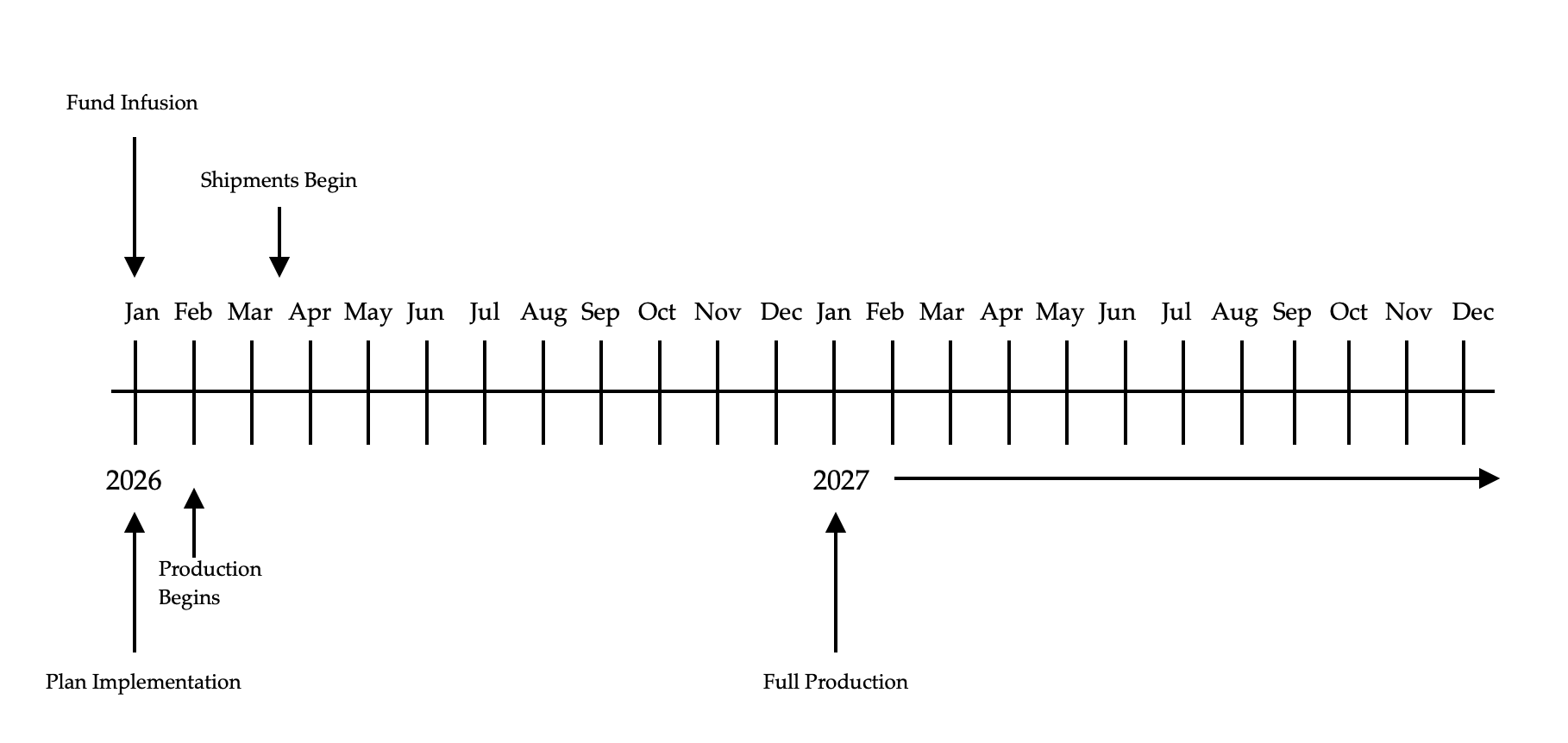

Timeline

Management Team

-

Cecil Lewis

CEO & PRESIDENT

-

Greg Hensley

PE (KY)

DIRECTOR OF PROPERTY DEVELOPMENT

-

Gary Napier

GENERAL COUNSEL

-

Tom Shepherd

VP, PLANT OPERATIONS, QUALITY CONTROL & DISTRIBUTION

-

Keith Smith

PE (KY, WV), RLS (WV)

VP, OPERATIONS

Opportunity available for investing purposes.

Property development/reactivation of mines starting with 10K increasing in October 2023 and increasing to 100K per month with investment dollars allowing sustained production levels by July 2024.4.5MM to 5MM recoverable ton reserve base with additional reserves available.Property located in Southeastern, Kentucky.Thermal and Specialties Metal product (specialty coal), estimated gross profit of $35+ per ton.

Investment opportunity for interested parties is as follows:

$10MM initial investment.Return on $10MM investment at 8% interest over a five (5) year period plus $3MM for % Stock Ownership and $7MM investment at 8% interest over a five (5) period.